Image source: Getty Images

The steady returns and growth potential that dividend stocks offer make them very attractive for a second income. Whether you want to supplement a salary or build on a retirement fund, it’s an essential part of most income investment portfolios.

When talk turns to passive income ideas in the UK, the word dividends is usually not far away. They are especially popular right now as lower prices lead to higher yields. That means FTSE 100 index Full of profitable opportunities.

One of my most important income generating investments is Phoenix group (London Stock Exchange: Phoenix), which represents approximately 25% of my dividend income this quarter.

Here I’ll explain why I think it’s currently one of the best dividend stocks to consider for a second income.

Firm demand

Phoenix operates in the life insurance and annuities industry and is likely to generate stable revenues in the indefinite future. Its business model focuses on managing life funds and closed-end retirement books, creating a predictable stream of income that supports dividends.

The group was established in 1857 as the Pearl Loan Company, and is now the parent company of major British insurers Standard Life, SunLife, ReAssure and Ark Life. It employs 8,165 staff, serving clients across the UK, Ireland and Germany.

Devotion to shareholders

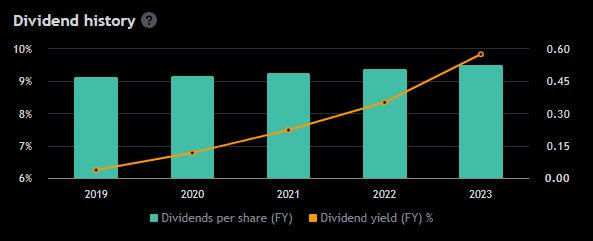

Phoenix prioritizes returning surplus cash to shareholders through dividends. It has been increasing its annual dividend for nearly a decade, rising from 40.52p per share in 2015 to 52.65p today. It is growing at an average rate of approximately 3% per year, and is likely to exceed 54p in 2025.

Recently, the share price decline has pushed the yield to 10%, making it very attractive. Not that it was low at all. Over the past 10 years, it has been between 6% and 9%, much higher than the FTSE 100 average of 3.5%.

Risks to consider

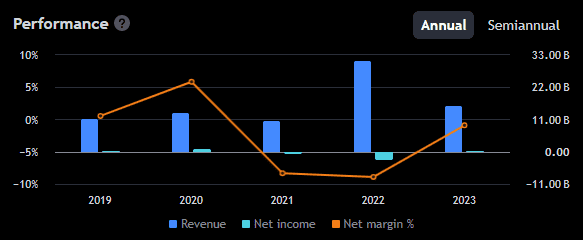

Late economic challenges in the wake of the pandemic have suppressed growth, and so has the group Unprofitable In 2021 and 2022. This has contributed to a 32% decline in stock prices over the past five years and prompted efforts to create new avenues for growth.

The group subsequently accumulated significant debt as part of its mission to grow through acquisition-led expansion. For now, the debt appears to be under control, but if it gets worse, it could limit the cash it has available for day-to-day operations.

High interest rates may cause trouble for the company, affecting debt repayment and asset valuation. It can also put pressure on a company’s earnings if interest rates fall too low. Given the current uncertainty about where UK interest rates are headed, this is certainly a risk we need to be aware of.

Long term view

when Planning a strategy For income investing, it pays to think long term. A little patience can lead to huge gains in the future.

With Phoenix’s stock price now near a 10-year low, I expect bargain hunters to help spark a recovery in 2025.

Either way, I plan to keep the cash drip-fed in stocks for years to come, with the goal of increasing my dividend income for retirement.

https://www.fool.co.uk/wp-content/uploads/2021/03/RoadTrip.jpg

2024-12-19 08:25:00